Highlights:

- 13,500-metre maiden drill program completed at the high-grade Polymetallic B26 Deposit; 44 holes drilled with assays from 34 holes pending.

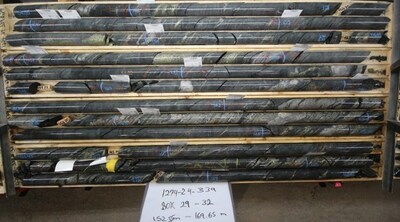

- Drillhole 1274-24-339 was designed to test the lateral extension of the high-grade lens identified in holes 1274-24-293 and 294, which were released on February 29, 2024. These holes intercepted 4.0% CuEq over 22.7 metres (293), including 6.3% CuEq over 10.6 metres, and 4.1% CuEq over 34 metres (294), including 11.4% CuEq over 10.6 metres.

- Drillhole 1274-24-339 intercepted mineralization 20 metres east of 1274-24-294, with a 106.5-metre interval of strong stringers observed from 83.0 to 189.5 metres, corresponding to a vertical depth starting about 20 metres below the bedrock contact. The potential down-dip extension of this high-grade lens remains open.

LONDON, ON, April 26, 2024 /CNW/ – Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) (“Abitibi” or the “Company”) is pleased to provide an update on the 13,500 metre maiden drill program at the B26 Polymetallic Deposit (“B26”, the “Project” or the “Deposit”) completed under the first phase of a fully funded 30,000-metre 2024 field season. Abitibi Metals is fully funded with $18.5 million to complete the remaining 16,500 metres planned for the 2024 work program and an additional 20,000 metres in 2025, which will be incorporated into a Preliminary Economic Assessment to complete the option. On November 16th, 2023, the Company entered into an option agreement on the B26 Deposit to earn 80% over 7 years from SOQUEM Inc (see news release dated November 16, 2023).

The Company has identified significant semi-massive and massive sulphides in infill drilling at the Central Lens of the B26 Polymetallic Deposit, where it recently announced some of the highest-grade intercepts in the Project’s history, including 11.4% CuEq over 10.6 metres at 135 metres depth in 1274-24-293 and 6.3% CuEq over 10.6 metres at 120 metres depth in 1274-24-294.

Drillhole 1274-24-339, advanced to test the immediate extension 20 metres east of the high-grade lens identified in #293 and #294, intercepted copper mineralization concentrated in separate bands varying in thickness from 0.4 to nearly 4 metres with chalcopyrite volume evaluated between 10% and 60% and forming a 106.5 metres long interval of mineralization observed from 83 to 189.5 metres.

Jonathon Deluce, CEO of Abitibi Metals, commented, “The drilling at B26 continues to deliver exceptional observations of continuity of visual copper mineralization, and #339 extends the high-grade lens outlined in #294 laterally, 20 metres to the east. This hole continues to add to the goal of better defining the high-grade lens while also outlining the lower-grade near-surface halo, supporting our bulk-tonnage open pit target. We look forward to releasing our next batch of results early next week. With the copper price breaking out, projects like B26, located in the world-class jurisdiction of Quebec, stand out globally for their potential to deliver critical metals at a time when there is a clear rising need for copper.”

| Table 1: 1274-24-399 & 340 Drill Coordinates | |||||||

| Drill hole number | Target | UTM East | UTM North | Elevation | Azimuth | Dip | Length (m) Drilled |

| 1274-24-339 | B26 Central Zone | 652945 | 5513382 | 276 | 359.4 | -60.8 | 351 |

| 1274-24-340 | B26 Central Zone | 652945 | 5513382 | 276 | 346.9 | -56.3 | 325 |

Note: 1274-24-340 was initially planned to test the westward lateral extension and down dip from 1274-24-294 and expand its influence. Unexpected levels of drill deviation brought the trace back to the proximity of 1274-24-294.

Qualified Person

Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, who is a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

Investor Relations Agreement

Additionally, Abitibi announces that it has engaged Fairfax Partners Inc. (“Fairfax”) for a one-month term to provide social media marketing services to assist in the Company’s marketing efforts and market presence. The services include content development, social media campaign and analytics. Fairfax will be compensated C$32,880 (plus GST) for their services during this period. Abitibi will not issue any securities to Fairfax as compensation for its marketing services. As of the date hereof, to Abitibi’s knowledge, Fairfax (including its directors and officers) does not own any securities of Abitibi and maintains an arm’s-length relationship with the Company.

About Abitibi Metals Corp:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a historical resource estimate1 of 7.0MT @ 2.94% Cu Eq (Ind) & 4.4MT @ 2.97% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modelled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce, Chief Executive Officer

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Note 1: A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The issuer is not treating the historical estimate as current mineral resources or mineral reserves. Source: Rapport Technique NI 43-101 Estimation des Ressources Projet B26, Québec, For SOQUEM Inc., By SGS Canada Inc., Yann Camus, ing., Olivier Vadnais-Leblanc, géo., SGS Canada – Geostat., Effective Date: April 18, 2018, Date of Report : May 11, 2018

Note 2: Copper Equivalent values were calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Metal recoveries of 100% are applied in the copper equivalent calculation. The application of a copper equivalent is a comparison measure used to level variable metal ratios. Results are not related to the recoveries and by virtue of the value of a mining production.

Note 3 – Sources:

Fayard, Q, Mercier-Langevin, P., Wodicka, N., Daigneault, R., & Perreault, S. (2020). The B26 Cu-Zn-Ag-Au Project, Brouillan Volcanic Complex, Abitibi Greenstone Belt, Part 1: Geological Setting and Geochronology.

Fayard, Q. (2020). CONTRÔLES VOLCANIQUES, HYDROTHERMAUX ET STRUCTURAUX SUR LA NATURE ET LA DISTRIBUTION DES MÉTAUX USUELS ET PRÉCIEUX DANS LES ZONES MINÉRALISÉES DU PROJET B26, COMPLEXE VOLCANIQUE DE BROUILLAN, ABITIBI, QUÉBEC

Forward-looking statement:

This news release contains certain statements, which may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company’s behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi’s forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects,” “estimates,” “anticipates,” or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results “may,” “could,” “might” or “occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.