January 11, 2024 – TheNewswire – London, Ontario – Abitibi Metals Corp. (CSE:AMQ) (OTC:AMQFF) (FSE:4KG) (“Abitibi” or the “Company”) is pleased to announce that it has engaged the services of Forage DCB Drilling of Rouyn-Noranda (“DCB”) to complete the near-term drill program for the high-grade B26 Polymetallic Copper Deposit (“B26” or the “Project”).

Jonathan Deluce, CEO of Abitibi Metals stated: “We are thrilled to partner with DCB and bring a top-notch team together for the maiden drill program at the high-grade B26 Polymetallic Copper Deposit. As we launch the first phase of a fully funded 30,000 metre drill program, the selection of the right drilling contractor is critical. Our pursuit of an accurate mineral resource estimate requires expertise and precision and DCB’s commitment to excellence is second to none as a firm that operates at the highest standards. We look forward to mobilizing in the coming days and commencing the advanced exploration drill program shortly after mobilization.”

The Company is also pleased to announce that the exploration program will be led by Mr. Martin Demers, P.Geo. Mr. Demers is a professional geologist, P. Geo., with over two decades of experience, with much of it focused on the Abitibi Region of Quebec, Canada.

Mr. Deluce continued: “Abitibi has brought together a top-notch team to develop the high-grade B26 Polymetallic Copper Deposit. We are very excited to work with Martin Demers, Eric Kallio and Shane Williams, three exceptional names in the mining industry who have been instrumental in the advancement and development of significant Canadian projects. We are very excited about the upcoming drilling season at the high-grade B26 deposit and are thrilled to collaborate with industry leaders with the planning of this program.”

B26 Polymetallic Copper Deposit Summary

Located within the prolific Abitibi Greenstone Belt, B26 comprises 66 claims covering 3,328 hectares in the Eeyou Istchee Baie-James territory and represents a significant opportunity to develop a copper, zinc, gold, and silver Polymetallic Deposit in a region with a rich history of base and precious metal production, which includes the Detour and Casa Berardi Mines. There is year-round road access with a power line running through the Project.

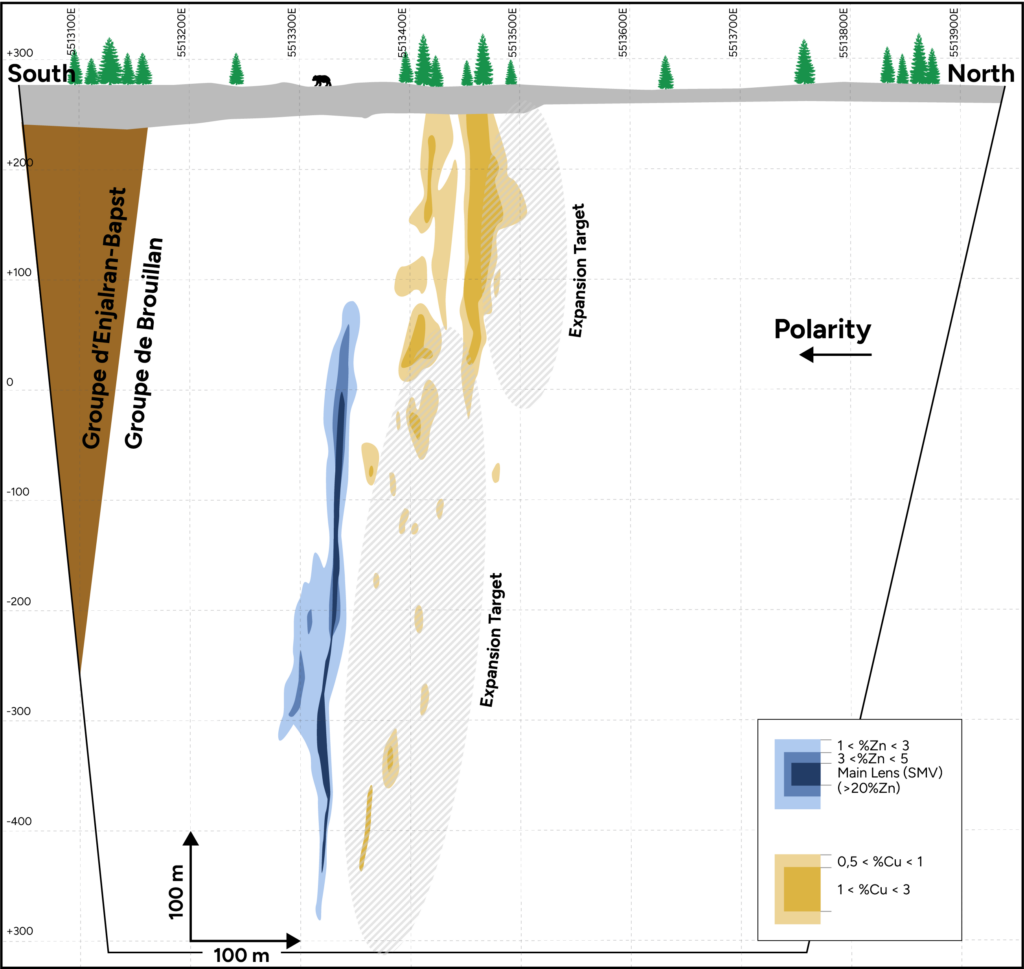

Abitibi is the first public company with the option to earn into the B26 Deposit. With a strike length of 1 km and depth extent of 0.8 km, both of which are open for expansion, Abitibi will focus on delivering shareholder value with an aggressive exploration approach which includes a fully financed approximately 30,000 metres of drilling in 2024 that will focus on advancing and expanding the existing underground resource (Ind: 7.0MT @ 2.94% Cu Eq & Inf: 4.4MT @ 2.97% Cu Eq) while delineating its open-pit potential.

Property highlights include:

- 2018 resource that includes 254 holes over 115,311 meters, advancing the asset to a significant resource that includes, across all categories, 400 million pounds of copper, 286,000 ounces of gold, and significant zinc silver exposure.

- B26 Resource Summary (2018)

- Indicated: 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag)

- Inferred: 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag)

- Drilling has established the continuity down to a vertical depth of 800 meters and the deposit remains open at depth and laterally with strong historical intercepts* including:

- 2.32% Cu Eq over 89.5 metres (1274-13-117)

- 3.05% Cu Eq over 48.1 metres (1274-16-224)

- 8.95% Cu Eq over 11.5 metres (1274-14-152)

- Within 7 km of the historical Selbaie Mine, a similar Polymetallic Copper Deposit with a variety of mineralization styles and element combination, that had a historical resource of 56.9 Mt @ 0.87% Cu, 1.85% Zn, 0.55 g/t Au, 39 g/t Ag (CONSOREM 2012). Reference to this nearby property is for information only, and there are no assurances that the Company will achieve the same results at the B26 Deposit.

The Company will advance B26 through a first-year exploration plan focused on 3 milestones:

- 30,000 Metres of Drilling. The Company anticipates the completion of at least 30,000 metres in the first year. Phase 1 will concentrate on high-priority infill drilling in areas with higher metal factors within the resource, roughly from surface down to 300 metres and exploring mineralized lenses continuity and geometry, and expansion possibilities.

- Updated Internal Resource 3D Model. Through the review of the 2018 resource, the Company has identified opportunities for improvement, which will strengthen our drill plan and a potential increase of current tonnage without further drilling. These areas include a) geological modelling to better identify high‑grade lenses to generate strong resource growth-focused drilling; b) reviewing and analyzing additional samples to determine the correct density factor to include in the updated internal resource / 3D model as the Company believes the density factor could be currently understated, which could result in the correct factor contributing additional tonnage above the 2018 resource numbers; c) reviewing and analyzing metal grade variability for resource estimation update for gold and silver grades; and d) completing a robust 3D and internal resource model which will provide a strong basis for evaluating economic potential.

- Gravity Survey. The Company is planning a Gravity Survey grid to cover extensions of the VMS contact to help model the geology, primarily the mafic-felsic contacts and sulphide-rich environment, in order to target new mineralized extensions close to the surface and at a moderate depth (300-600 metres). This is aligned with our first-year objective of improving our understanding and model of the open-pit potential of the Project.

The following plan view and central section provide an overview of the current mineralization and expansion potential:

Terms of the Definitive Agreement:

Under the terms of the Definitive Agreement, Abitibi has the right to earn an 80% interest in the Project through a two‑phase option, subject to a net smelter return royalty of 2% granted to SOQUEM. Abitibi will have the right to buyback 1% of the net smelter return royalty for two million dollars (CAD).

Phase 1: In order to earn an undivided 50% interest in the Property, Abitibi shall have made total cash payments of $400,000, issued 9.9% worth of common shares in the capital of Abitibi to SOQUEM and incurred Work Expenditures of $7,500,000 in total over 4 years.

Phase 2: In order to exercise the Second Option to acquire an additional 30% interest for a total undivided 80% interest in the Property, Abitibi shall finance and deliver a PEA, as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (Canada), issue shares to top up SOQUEM’s total Abitibi equity ownership to 9.9% of common shares, make a cash payment of $1,000,000 less the reduction calculated below and incur further Work Expenditures of $7,000,000 on the Property within 3 years of Abitibi exercising the 50% Option. Abitibi will determine the value of shares issued to top-up SOQUEM based on a 10-day weighted average preceding the date of issuance, which will be deducted from the $1 million cash requirement to exercise the 80% option.

Upon 80% Option Exercise: The project shall convert into a joint venture with Abitibi taking 80% of the future development expenditures and SOQUEM taking 20% of the future development expenditures.

Investment Relations Agreement

The Company is pleased to announce the engagement of Triomphe Holdings Ltd. (dba Capital Analytica) (“Capital Analytica”) for investor relations and communication services (the “Consulting Agreement”) as the first consultant retained as part of its market awareness strategy. Capital Analytica is a Nanaimo based company owned and operated by Jeff French who is arms length to the Company

Jonathan Deluce, CEO of Abitibi Metals stated: “As the first public company to have the opportunity to option B26, we fully intend on pairing our aggressive exploration program with a strong marketing and awareness strategy in order to deliver B26 the attention it deserves. With the closing of our recent financings, we are set to increase our marketing and awareness initiatives, in tandem with achieving a complete OTCQB listing, and look forward to providing further updates as we advance the high-grade B26 Polymetallic Copper Deposit.”

The Consulting Agreement has an initial term of six months, under which the Company will pay to Capital Analytica an aggregate of $120,000, and has an option to renew the Consulting Agreement for an additional 6 months at a rate of $10,000 per month, unless terminated earlier in accordance with the Consulting Agreement.

Pursuant to the terms of the Consulting Agreement, Capital Analytica will provide ongoing capital markets consultation, ongoing social media consultation regarding engagement and enhancement, social sentiment reporting, social engagement reporting, discussion forum monitoring and reporting, corporate video dissemination, and other related investor relations services.

Change in Directors

The Company announces the resignation of Wesley Hanson and Joseph Luongo from Abitibi’s Board of Directors. The Board would like to sincerely thank Mr. Hanson and Mr. Luongo for their service and contribution to the Company and wishes them well in their future endeavours.

About Abitibi Metals Corp.:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Copper Deposit (Ind: 7.0MT @ 2.94% Cu Eq & Inf: 4.4MT @ 2.97% Cu Eq) and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modelled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce, Chief Executive Officer

For more information, please call 226-271-5170, email info@abitibimetals.com, or visit https://www.abitibimetals.com.

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Source 1: Fayard, Q, Mercier-Langevin, P., Wodicka, N., Daigneault, R., & Perreault, S. (2020). The B26 Cu-Zn-Ag-Au Project, Brouillan Volcanic Complex, Abitibi Greenstone Belt, Part 1: Geological Setting and Geochronology.

Source 2: Rapport Technique NI 43-101 Estimation des Ressources Projet B26, Québec, For SOQUEM Inc., By SGS Canada Inc., Yann Camus, ing., Olivier Vadnais-Leblanc, géo., SGS Canada – Geostat., Effective Date: April 18, 2018, Date of Report : May 11, 2018

Source 3: Fayard, Q. (2020). CONTRÔLES VOLCANIQUES, HYDROTHERMAUX ET STRUCTURAUX SUR LA NATURE ET LA DISTRIBUTION DES MÉTAUX USUELS ET PRÉCIEUX DANS LES ZONES MINÉRALISÉES DU PROJET B26, COMPLEXE VOLCANIQUE DE BROUILLAN, ABITIBI, QUÉBEC.

* Not necessarily representative of the of the true width of mineralization

Copper Equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Metal recoveries of 100% are applied in the copper equivalent calculation.

Forward-looking statement:

This news release contains certain statements, which may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company’s behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi’s forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects,” “estimates,” “anticipates,” or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results “may,” “could,” “might” or “occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.

Copyright (c) 2024 TheNewswire – All rights reserved.