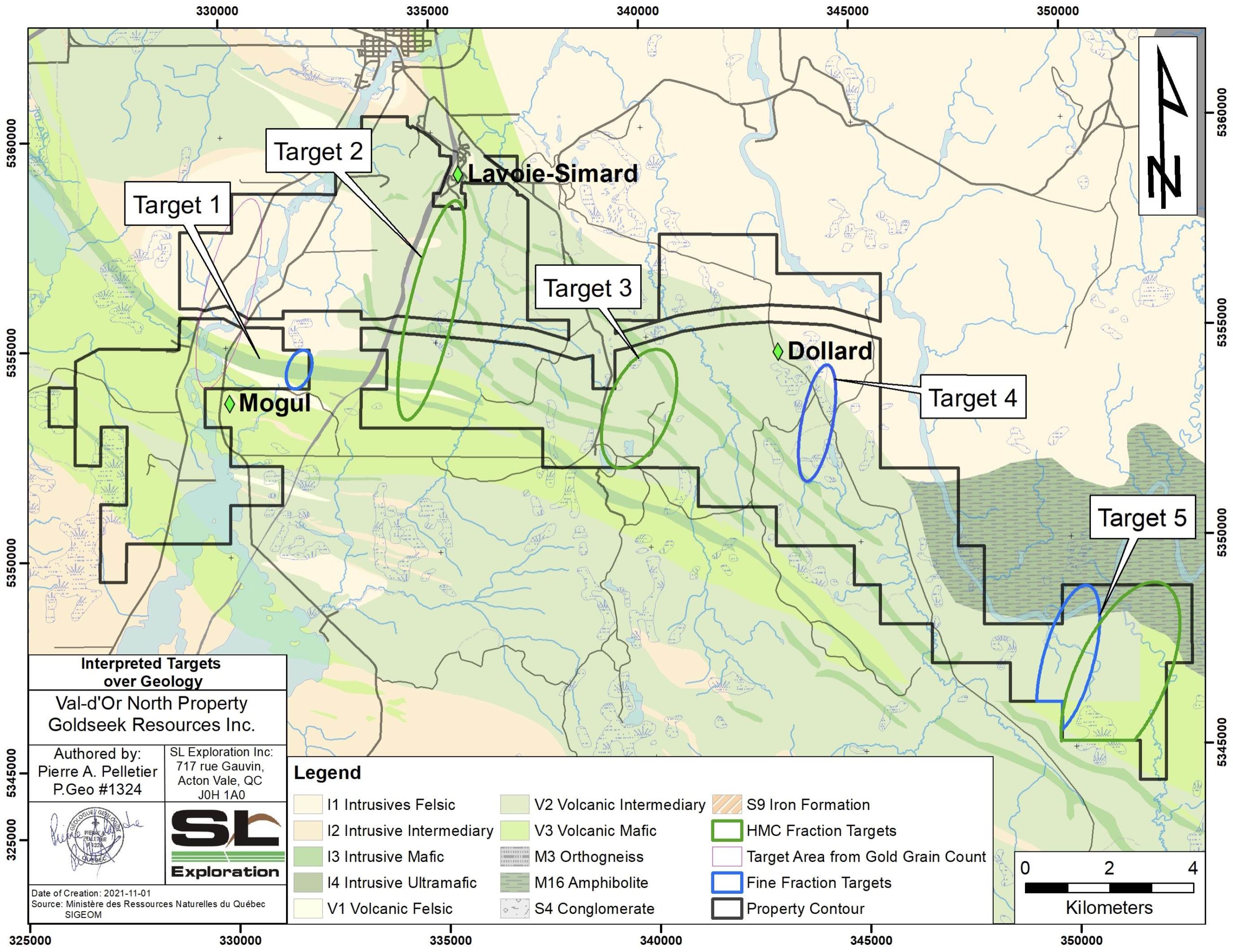

February 15, 2022, London, Ontario – Abitibi Metals Corp. (CSE:GSK) (FSE:4KG) (“Goldseek” or the “Company”) is pleased to announce that it has updated its exploration targets on the Val-d’Or North Property after receiving 2021 survey results and completing an updated interpretation. The Company has currently defined 5 targets that are based on polymetallic anomalies in soil samples that show consistent anomalies in till. A follow-up is targeted for this summer to better define and characterize the targets.

Goldseek’s President & CEO Jon Deluce states,”We are excited to announce the continued development of our targets at the Val D’Or North Property. The presence of high gold grain counts, especially at our Target 3 supports the potential of this grassroots project in a camp that has seen lots of recent M&A. We continue to deliver on our overall plan by developing our grassroots portfolio systematically while being open to partnerships while focusing on our near-resource flagship Beschefer on the Detour Gold Trend.”

2020-2021 Surveys

In 2020, the Company completed a till survey in order to perform Heavy Mineral Concentrates (“HMC“) and assayed the concentrates (see news release dated April 20th, 2021). In 2020 and 2021, fine fractions analysis in till confirmed the targets generated by the HMC survey and also identified a fifth target on the Property.

The Targets

Multi-element assays on HMC and fine fraction of the 2020-2021 samples were used to define anomalous samples for precious metals (gold, silver) and base metals (copper, zinc, lead, etc) in heavy mineral concentrate and in fine fraction. The best response for targeting purposes was provided from the gold and silver content in HMC, associated with gold in the fine fraction.

Target 1 is located north of the Mogul showing, which has been described as a VMS system hosted at the contact between felsic tuffs and basalts. The Mogul showing presents copper, silver and zinc anomalies in grab samples: 1365ppm Cu, 0.9g/t Ag; 7670 ppm Cu, 1245 ppm Zn and 468ppm Au, which were associated with a massive sulphide lens in felsic tuff and basalt (Roberstson, D., et al., 1988).

Target 2 is south of the Lavoie-Simard showing, which has been described as a Mo-Cu-Au-Zn showing, returning up to 3.32% Mo, 0.2% Cu, 2.06% Zn, 1.03g/t Au and 5.14g/t Ag (Ingham, 1953). Target 2 could be the down-ice manifestation of this showing as it presents a very narrow dispersion trail in a NNE-SSW direction. It is also possible that new mineralization is the source of Target 2.

Target 3 is a dense cluster of the highest calculated ppb Au values (295ppb, 380ppb, and 1747ppb Au); highest total gold grain count (125 and 165 total grains); highest gold value in HMC assays (1.485ppm and >25ppm Au) and high values in the fine fraction assays (0.107ppm Au) indicating a probable proximal source to the NNE of the defined anomaly.

Target 4 is a small cluster of medium to high total gold grains count (10, 19, 19 and 30 total grains) with medium values of 4.9ppm Zn in the HMC and 38ppm Zn in the fine fraction. The source of the anomaly could be in the continuity of the Dollard showing about 1km west of Target 4. The Dollard showing was sampled in sheared and carbonatized andesite with massive sulphide zones mineralized in 2200ppm to 2.52% Cu (Cote, R., and al., 1976). The contact between the felsic and mafic units is a good target.

Target 5 is a less defined cluster of HMC assays anomalous in gold, silver, copper and zinc (1.765ppm Au, 2.6ppm Au, 0.275ppm Ag, 0.432ppm Ag, 37.3ppm Cu and 139.5ppm Zn), while the fine fraction returned anomalous values in silver, copper and zinc (0.135 ppm Ag, 0.182ppm Ag, 16.65ppm Cu, 15.5ppm Cu, 38.5ppm Zn, 33.0ppm Zn and 40.1ppm Zn). The HMC and fine fraction assays are slightly separated and result from the glacial remobilization of the different fractions during the various glacial ages (and subsequent remobilization of anterior glacial deposits).

Figure 1. Targets on the Val-d’Or North Property

2022 Follow-up

The work program for 2022 will include trenching to better define the geology and potential source. Following that, geophysics could be used to define drill targets to test the expected source of anomalies.

Stock Options:

The Company announces it has granted incentive stock options to certain directors, officers and consultants of the Company to acquire an aggregate of 2,000,000 common shares in the capital of the Company at an exercise price of $0.15 cents (the “options”) in accordance with the Company’s 10% rolling incentive stock option plan. The options are exercisable for a three-year term expiring February 15th, 2025.

Investor Relations:

The Company is pleased to announce that it has entered into an investor relations agreement (the Agreement) with MI3 Communications Financieres Inc (MI3).

The Agreement is for an initial term of twelve months renewable on an annual or semi-annual basis and may be terminated upon 30 days’ written notice by either party. In consideration for the services of MI3, the Company has agreed to pay a fee of $3,000 per month. Pursuant to the Agreement, Goldseek shall also grant MI3 a stock option to purchase 300,000 common shares of Goldseek at a price of $0.15 per share for a period of 3 years with one quarter of the options vesting every three months. If the Agreement is terminated, the options expire 6 months after termination.

Goldseek’s President & CEO Jon Deluce states, “I’m excited to welcome Quebec-based MI3 to our team. In 2021 we succeeded in developing our Beschefer Project on the Detour Gold Trend in Quebec headlined by 4.92g/t Au over 28.65 meters. However, we remain an unknown story which is why we are excited to partner with a credible IR firm to introduce our story to members of the Quebec financial community.”

Qualified Person

This press release was prepared by Steven Lauzier, VP Exploration for Quebec, P.Geo,OGQ and by Pierre-Alexandre Pelletier, P.Geo OGQ, who are qualified persons as defined under National Instrument 43-101, and who reviewed and approved the geological information provided in this news release.

About Abitibi Metals Corp.

Abitibi Metals Corp. is a Canadian exploration company with a portfolio of assets in Ontario and Quebec, Canada. By identifying six projects in world-class mining locations, Goldseek is poised to deliver shareholder value through rigorous exploration and development on these properties. Our mission is to find the next major discovery in the mining camps of Urban Barry, Quevillon, Val D’Or, and Detour Gold Trend in Quebec and Hemlo in Ontario.

ON BEHALF OF THE BOARD

Jonathon Deluce

Chief Executive Officer

Telephone: 226-271-5170

For more information, please contact:

Abitibi Metals Corp.

E-mail: goldseekresources@gmail.com

The reader is invited to visit Goldseek’s web site https://www.goldseekresources.com/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release

References:

ROBERTSON, D., RAINSFORD, D., PARADIS, S., RAMPTON, V. N., THOMAS, R. D., MARTIN, L., RENNICK, P., 1988. REPORT OF GEOPHYSICAL, GEOLOGICAL, GEOCHEMICAL SURVEYS AND DIAMOND DRILLING, COURVILLE-SENNETERRE PROPERTY. FINNETH EXPL INC, rapport statutaire soumis au gouvernement du Québec; GM 46377, 214 pages, 22 plans.

Cote, R., Beaulieu, J R., Verly, G., Morin, G., 1976. Geology and Compilation, Barry Project. Shell Canada Ltd. Statutory work report submitted to the Government of Quebec. GM 38830, 4 maps.

Ingham, W N., 1953. Information Report. Claims Lavoie. Statutory work report submitted to the Government of Quebec. GM 02270, 2 pages.